Everyone is embracing reports that almost all enterprises are repatriating workloads from public clouds to local, on-premises infrastructure. The truth: The repatriation number is real and misleading at the same time.

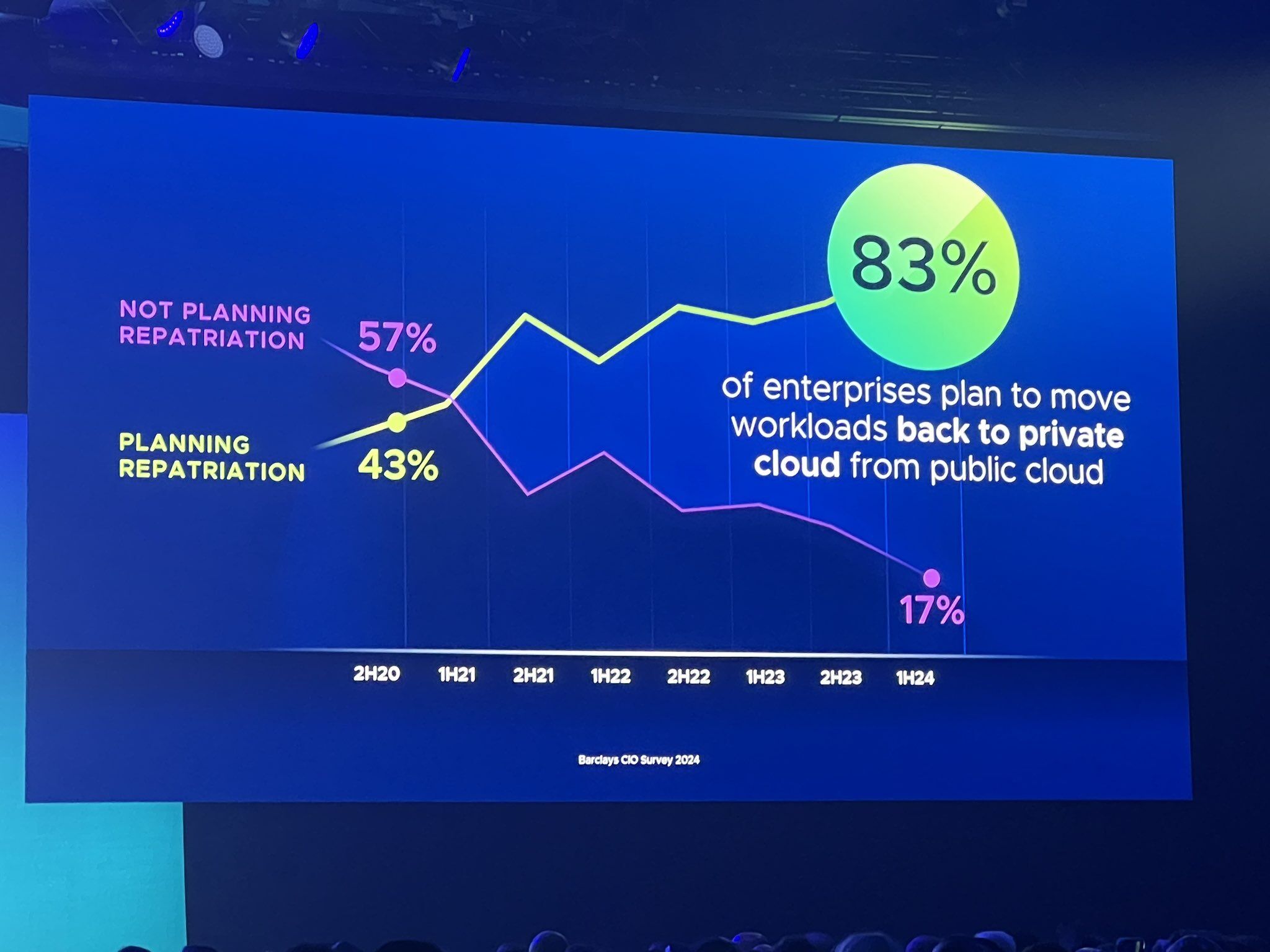

A number keeps popping up in technology and channel conversations: 83%. According to a survey conducted by banking giant Barclays, that’s the percentage of enterprises repatriating workloads from public clouds to on-premises or private cloud infrastructure.

This eye-popping statistic has generated excitement across the industry. It signals a potential shift away from hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. It also suggests a resurgence in commercial hardware sales after years of sluggish—if not declining—performance. Additionally, this trend implies that enterprises will require more software and support services, indicating potential growth for channel partners.

Barclays isn’t the only source amplifying this figure. For the past few years, analyst firm IDC has reported that somewhere north of 70% of enterprises are repatriating workloads to on-premises or hybrid cloud infrastructure. This trend is further corroborated by many global systems integrators, who observe their customers seeking guidance and support for pulling applications and processes out of the hyperscalers.

At the VMware Explore event in Las Vegas this week, Broadcom’s leadership prominently displayed the 83% figure several times to their customers and partners as evidence of the opportunity to sell its virtualization software to customers weary of the high and unpredictable costs of public clouds. Broadcom CEO Hock Tan even remarked that enterprises have developed post-traumatic stress disorder from the dizzying expense of public cloud services.

The 83% figure has gained so much traction that Michael Dell, the founder and CEO of Dell Technologies, posted a photo of the slide shown at the Broadcom-VMware event, calling it, “Not surprising.”

But the question remains: Is this number accurate?

Several partners have asked me this after repeatedly hearing the data point. While they’re seeing customers reconsider their public cloud strategies and expenditures, they’re not witnessing this mass exodus from hyperscaler infrastructures. In fact, the economics of hyperscalers still make hosting workloads in public clouds and purchasing add-ons through their marketplaces advantageous.

My response: I believe the number is real, but I also don’t think it tells the whole story.

Economist Charles Wheelan said, “It’s easy to lie with statistics, but no one will believe you without them.” The Barclays repatriation stat is a good example of this axiom. While I’m not suggesting that Barclays or others using this number are lying, they are telling convenient stories that are loosely based on reality.

Let’s examine the facts. First, what does the number represent? Simply put, it’s the percentage of enterprises repatriating workloads. So, if we’re talking about 100 businesses, 83 of them are moving workloads out of public clouds. But how many workloads? What kind of workloads? Are these large, enterprise-wide, and mission-critical workloads, or are they relatively smaller applications isolated within specific business units? Are these workloads worldwide or regional? And how significant is the shift in spending they represent?

The problem with the 83% figure is that it represents companies, not workloads. So if 83% of enterprises decide to move one workload from the public cloud to their local infrastructure, the number remains true. But that doesn’t mean enterprises are racing for the public cloud exits. And we can see that as spending with hyperscalers continues to climb each quarter.

Why are hardware and infrastructure software vendors so excited about cloud repatriation? It comes down to growth. Hyperscalers have cut into traditional server, storage, and other infrastructure hardware sales. While infrastructure software continues to sell well, sales attached to hardware are soft. Workload repatriation means a return to growth.

Another factor driving vendors’ embrace of the repatriation figure is artificial intelligence. It’s generally accepted that enterprise AI deployments are too processing-intensive for public clouds. It’s not that public clouds can’t handle AI workloads—it’s just that it’s expensive. The belief is that enterprises will opt to build AI systems locally rather than rely on hyperscalers. This is why IDC forecasted a 10% increase in hardware infrastructure sales this year driven by AI.

I’m not saying repatriation isn’t a trend; it is. And I’m not saying that vendors and those promoting this repatriation figure are trying to mislead; they’re not—they’re simply telling a story to get partners and customers excited about current and future opportunities. However, before we embrace numbers like these—especially in a decision-making context—we must break them down and define them for what they really represent.

To quote the movie Anchorman, “60% of the time, it works every time.” In this case, 83% of the time, enterprises are thinking about repatriating workloads from public clouds. The safest interpretation is that there’s an opportunity with 83% of enterprises to have a conversation about their future infrastructure needs.

Larry Walsh is the CEO, chief analyst, and founder of Channelnomics. He’s an expert on the development and execution of channel programs, disruptive sales models, and growth strategies for companies worldwide.