Market analysts credit Microsoft’s market cap surge to investments in AI, but it’s more about the depth of its product portfolio and massive global channel.

Microsoft reclaimed the title of most valuable public company last week, ending Apple’s over 500-day run at the top. While momentum around generative artificial intelligence (AI) propelled Microsoft’s stock price, the software giant is also leveraging its unmatched global partner channel to drive growth over its iPhone-making rival.

As the first company to surpass a $3 trillion valuation, Microsoft can attribute its leading market cap to several key strengths. CEO Satya Nadella’s big, early bets on generative AI and cloud computing are paying off in surging Azure revenues. The company’s expansive business portfolio across productivity software, gaming, devices and more provides varied revenue streams.

However, much of Microsoft’s success traces back to its partner ecosystem comprised of over 450,000 resellers, integrators, ISVs, advisors and more. This channel powers over 90% of Microsoft’s revenues as partners build solutions on provides support services to Microsoft 365, builds solutions with Dynamics 365, sell Surface devices and attract customers to Azure. As Microsoft adds generative AI capabilities across its stack, partners integrate the technology into customer solutions.

Central to Microsoft’s channel strategy is its Azure Marketplace, where partners can sell add-ons and solutions for Microsoft products or run applications on the Azure cloud infrastructure. Last year, Microsoft reported $12 billion in partner-driven co-sell success, proving the mutual growth opportunity. The partner channel and marketplace flywheel Microsoft has engineered over the years provide stability even as new technologies reshape markets.

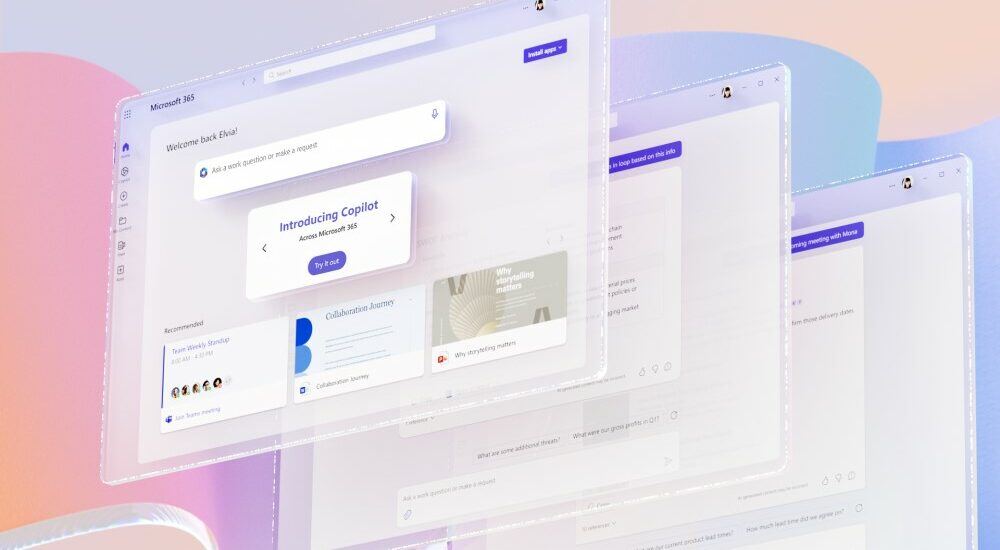

Contrast this with Apple, which saw over 500 days as market cap leader erased last week. The one-time tech innovator remains heavily iPhone-reliant, now facing slowing growth. Its devices and services ecosystem is formidable yet smaller in scale compared to Microsoft’s channel. As generative AI gains steam, Microsoft partners are rushing to capitalize on capabilities like the Bing chatbot and Copilot, which will integrate with most of Microsoft’s business applications. Apple has no comparable network effect to leverage as it plays AI catchup.

While Apple has strong ISV relationships, the company built by Steve Jobs is historically channel apathetic. For years, the message on its partner page had a simple message: We’re not accepting applications. More recently, Apple has touted enterprise relationships with global systems integrators such as Accenture and Deloitte. However, Apple’s B2B channel is a fraction of its consumer business.

Market analysts aren’t wrong that Microsoft’s investments in artificial intelligence are exciting investors and driving up its stock price. However, the market is inundated with AI-Washing, a tactic by technology companies to bolster their stock prices and valuations by talking about AI as if it were a reality today. Microsoft does have AI products and a development roadmap, but it also could be benefiting from the AI-Washing effect.

The next few years will indicate whether Microsoft’s partner flywheel can sustain its valuation lead. But for now, Microsoft is leveraging generative AI momentum and channel strength in its market position and fuel growth. Nadella’s long-game channel investments are paying dividends as partners drive the adoption of everything from Azure to Dynamics 365 to Surface. For Apple to reclaim the top spot, it will need to cultivate a similarly thriving ecosystem around any innovations.

Larry Walsh is the CEO, chief analyst, and founder of Channelnomics. He’s an expert on the development and execution of channel programs, disruptive sales models, and growth strategies for companies worldwide. Follow him on Twitter at @lmwalsh_CN.