AI systems are expensive to build and maintain, driving up prices; the rising AI costs should compel vendors and partners to sell more on value than features.

Artificial intelligence is undoubtedly transforming the way people work. Through AI applications, individuals can access information, create content, and communicate faster and with greater ease. The value of AI is often measured in the time it saves businesses and organizations.

But how much is AI really worth?

Canva, the cloud-based content creation platform, attracted attention last week when it announced a 300% price increase for its Teams plan, stating that the cost aligns with the benefits subscribers receive. OpenAI, the originator of the current AI wave, is considering a $2,000 per month subscription for its forthcoming advanced AI engines.

At the launch of its new Series 2 Core Ultra processor — developed under the code name Lunar Lake — Intel, alongside OEM partners such as Asus, Dell, HP, Lenovo, and Samsung, introduced a series of AI-powered PCs. Many of these machines carry hefty prices. Intel believes that both businesses and consumers will pay a premium for AI-enabled PCs because of the features and processing capabilities they offer.

While the world is recognizing the benefits of AI adoption, the associated costs are becoming more apparent. According to Gartner, large enterprises are spending between $5 million and $20 million on AI deployments, and that doesn’t take into account the growing expense of applications incorporating AI, which is driving up licensing and subscription costs.

The reasons behind rising AI costs are multifold. The processors that power AI PCs and services are significantly more expensive than conventional chips. For instance, a single Nvidia GPU can cost $30,000, and many data centers require extensive infrastructure upgrades to support AI systems. Microsoft’s capital spending on infrastructure increased by 19%, raising concerns among investors about the cost of developing AI services and the extended return on investment (ROI) timeline.

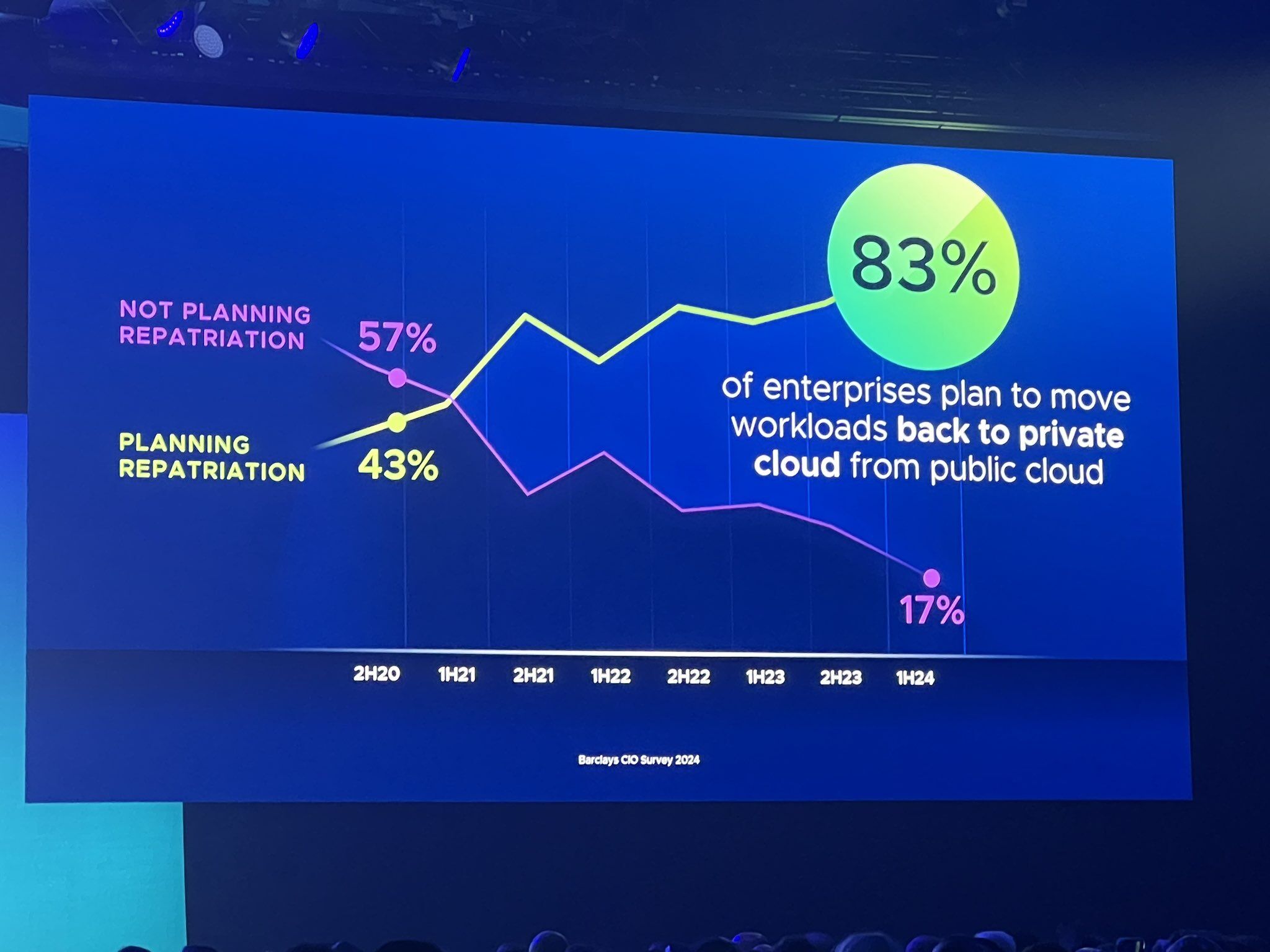

The high cost of AI systems and processing is driving hardware vendors to encourage businesses to host their applications locally rather than in public clouds. Dell’s recent positive earnings report was buoyed by a surge in AI-capable servers for private cloud and local data center refreshes.

Two trends are emerging in the market. First, AI is consuming a significant portion of IT budgets as enterprises are tasked with developing an AI strategy to enhance operational efficiency and save money. Second, enterprises are starting to feel the financial strain of AI adoption. Some analysts believe the market may have reached “peak AI,” with a few even dismissing it as a passing fad.

AI isn’t a fad, but it isn’t a cure-all for business challenges either. AI is a tool like any other machine or application. Its value lies not in the hardware, features, or applications themselves but in the use cases and benefits they deliver to users.

As vendors roll out more AI features and products, they must provide customers with compelling reasons to invest in specific AI systems and resources to justify the expense. Customer success is paramount, as businesses will need guidance and support in maximizing the use of their AI systems.

While many vendors encourage partners to focus on the features and functions of their AI products to generate customer interest and drive sales, they should instead teach partners to sell based on workloads and use cases. This will enable partners to sell on value. Despite rising costs, customers are willing to spend if they can clearly see — and eventually realize — tangible value.

Larry Walsh is the CEO, chief analyst, and founder of Channelnomics. He’s an expert on the development and execution of channel programs, disruptive sales models, and growth strategies for companies worldwide.