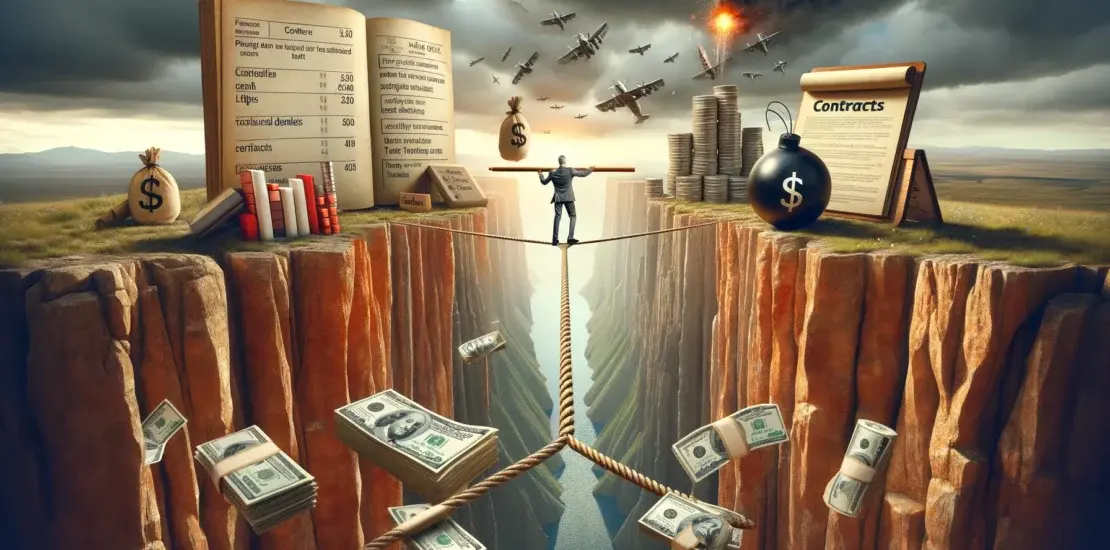

Long-term contracts help ensure recurring revenue keeps flowing, but vendors requiring partners to hold the paper on nontransferable licenses creates high risk.

Vendors love the recurring-revenue model. Subscriptions, or contractual sales, mean predictable revenue, which – when it flows successfully – gives investors greater confidence in long-term returns. And that leads to higher valuations.

Getting customers to sign a subscription is one thing. Getting them to renew is another. Any vendor that’s selling subscriptions or contractual services and not renewing at least 90% of their accounts is at risk of decreasing returns. Vendors not renewing at 67% spend more time and effort acquiring new accounts to replace their existing customers.

Vendors increasingly achieve stable recurring revenue by getting customers to commit to long-term contracts in exchange for pricing concessions. Increasingly, vendors are selling service contracts for two to seven years. Customers get price breaks, but they must commit to certain levels of annual spending over a protracted period.

It sounds like a good deal. And it is – if you’re the vendor or the customer. The partner in between? Not so much.

Vendors are making the same mistake they made before when it comes to selling services through the channel: making the partner responsible for the customer’s financial obligation.

When vendors lock a customer into a long-term contract, they tell Wall Street and Sandhill investors that piles of money are coming and won’t stop. But long-term contracts come with risks of default. If a customer defaults on a contract, for whatever reason, the revenue that vendors announced is no longer coming.

Many vendors have a solution for this too. They make it the partner’s responsibility. On paper, partners sell the contracts to the customer. Consequently, that makes them responsible for the payments. The customer pays the partner. The partner pays the vendor.

LAER – Land, Adopt, Expand, Renew – is commonly adopted by the vendor community as the model for selling services and subscriptions. This model, developed by the Technology & Services Industry Association (TSIA), makes clear that the goal is to renew and expand service-based accounts. It makes sense given that renewal keeps the recurring revenue coming and expansion means more revenue still.

However, key tenets of the cloud and service model are scalability and flexibility. If a customer’s needs change, it can always increase its consumption. Theoretically, a customer can decrease consumption too, but that’s much harder under these long-term contracts. Vendors don’t want to see service downgrades or “optimization” by their customers. It means that the revenue they were counting on disappears into the ether.

The licenses, seats, or nodes are nontransferable in many vendor contracts. Customers can allocate their capacity any way they like. What happens if a customer can’t use all its licenses or defaults and abandons them? Well, the partner can’t transfer or resell them to another customer.

The logic behind the no-transfer policy is simple: Those licenses were already sold. Reselling them will replace revenue on the books only; it won’t help grow the vendor’s business. So, defaulting customers often leave the partners holding the bag for payment obligations to the vendor.

Vendors will work with partners to mitigate the impact of defaulting customers and abandoned licenses. However, financial obligations and non-transfer policies often create a high-risk exposure to partners. Even though defaults are uncommon, they leave risk lingering over partners’ operations.

Vendors can implement changes to make it less risky for partners. Some vendors use third-party finance companies that have greater risk capacity to alleviate the burden on their partners. Others do allow license transfers, enabling partners to resell as long as they maintain the original price point.

Vendors must ensure that their subscription-based services don’t expose partners to excessive risk, making selling and supporting these services appear too hazardous to their business interests.

Larry Walsh is the CEO, chief analyst, and founder of Channelnomics. He’s an expert on the development and execution of channel programs, disruptive sales models, and growth strategies for companies worldwide. Follow him on Twitter at @lmwalsh_CN.